Quicken - Real-Time Card Notifications For Pending Transactions

- Hassle-free money management and bills viewing

- Portfolio, data monitoring performance facility

- Helps to business and personal expenses effectively

- Best personal finance tool for investment

Quicken - Real-time Money Management Software for Open Mortgage Advisors

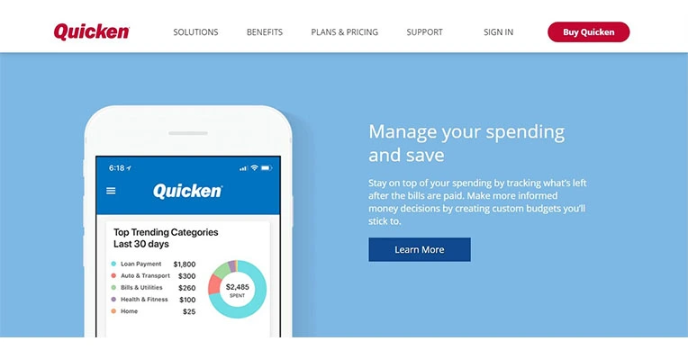

Using some loans and finance will help relieve some of the stress on money and handle your money effectively.

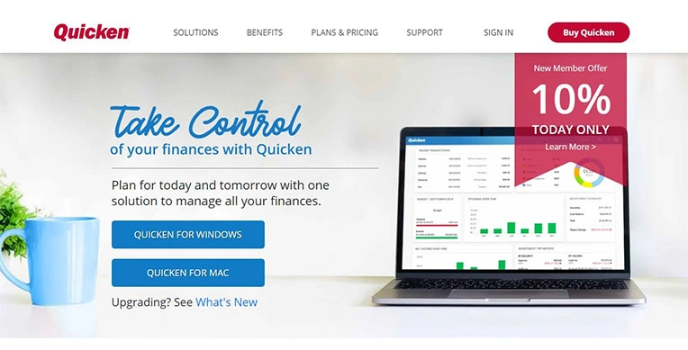

Personal finance software holds all this information in one convenient spot, whether it's monitoring the savings plan for your child's college fund or making sure you're not in the red for the month's grocery budget. Choosing the best peer-to-peer lending for investors might be challenging. Quicken is the best software to manage all your financial data.

Essential Features of Quicken Software

Flexible

For those who want human contact, Quicken personal finance software pairs a completely online application with open mortgage advisors. For many working Americans, it instantly verifies jobs and profits.

Other Kind Of Loans

It offers between eight and 30 years of custom fixed-rate loan terms. This peer-to-peer lending for investors software provides a wide range of loans, including renovation loans and certain mortgage products backed by the government.

Ideal For Quicken Loans

Quicken Loans offer a full non-bank range of fixed- and adjustable-rate home loans, mortgage refinancing, and jumbo loans for higher-priced homes. Applying with Quicken Loans for a mortgage will start with a phone call.

Mortgage Payback

A force of over 3,000 mortgage bankers, the company reports, is ready to assist. And that licensed banker is going to be the same individual you refer to in the loan process. Quicken's brand allows you to pick a fixed-rate loan term from eight to 29 years, the mortgage payback duration.

versatility

That allows you to fine-tune your monthly payment and have a little more versatility than the standard terms of 15 and 30 years.

Alternatives

Loan volume, especially FHA, with innovative technology and personal assistance on demand. Its mortgage rates and lender fees, however, are more significant than the median. If you have a low budget, try considering other options like CountAbout or Moneyspire.

Would you join to discuss on this product ?