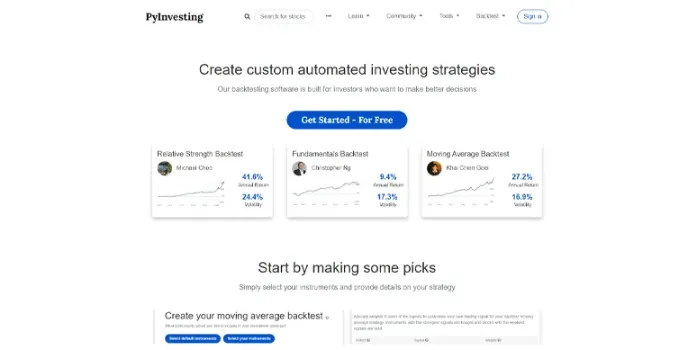

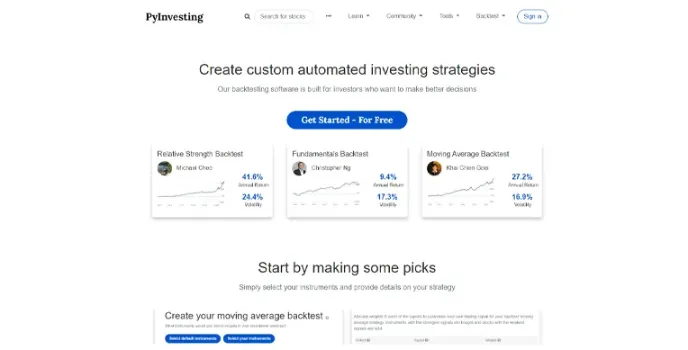

PyInvesting - Top Tool For Stock Backtesting And Strategies Market

- Provides trading strategies on different time frames and data sets

- Taking into account trading costs and commissions

- Avoids data overfitting of the model and built-in bias

- Provides plenty of valuable statistical feedback about a given system

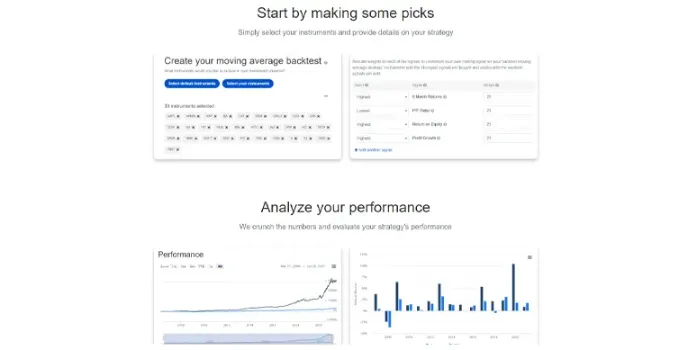

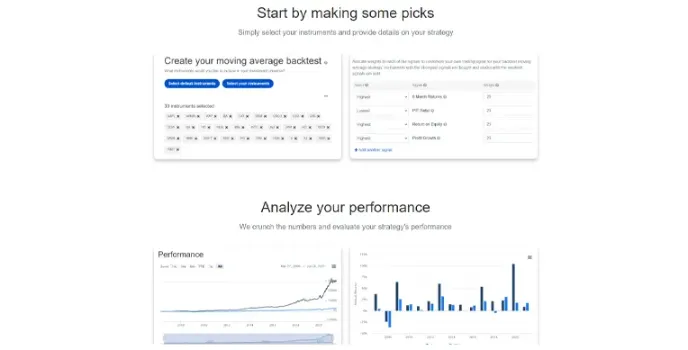

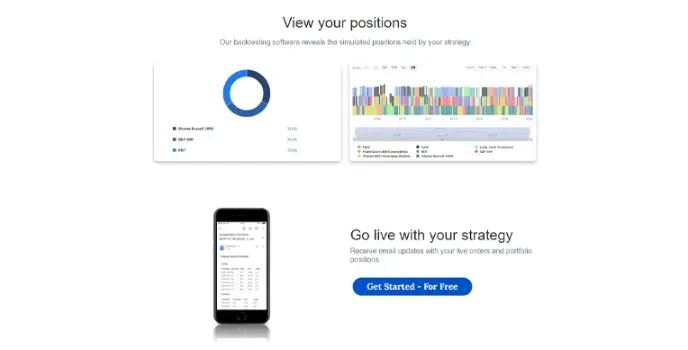

- All features are 100%-based on a visual interface

- Results are charted, making it easy to see the top performers

PyInvesting - Perfect Software To Create Automated Trading Strategies

After working as a software developer for a hedge fund, where he was in charge of the trading system, Ivan created PyInvesting. PyInvesting was built to assist him in managing his portfolio through a data-driven strategy. After a few months, he decided to open up the stock backtesting software to the community so that other investors could experiment with and build their quantitative trading approaches.

Significant Features Of PyInvesting

Multiple Usabilities

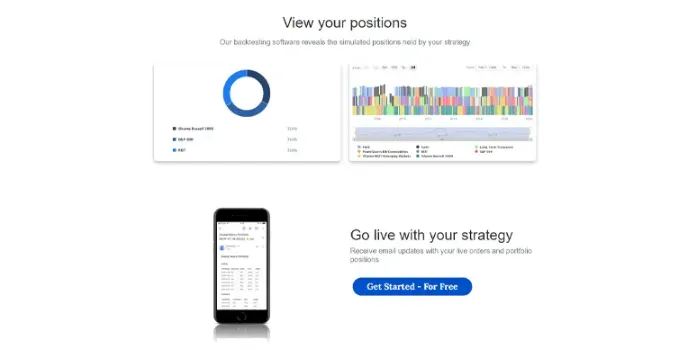

PyInvesting.com is still in its early stages, but it already includes three main sections: a screener, a backtester, and a live component that allows users to test their plan in real-time.

Effective Trading Features

Backtesting is essential for effective trading. It used to be a costly and exclusive activity for a select set of experts. It is now affordable for new investors and traders. Aside from that, free backtesting software can meet even the most demanding requirements.

Custom Email Alerts

The Forex Backtesting Software filters stocks depending on specified criteria, such as choosing the top 100 stocks by market cap. It allows users to go live with their strategy and receive daily emails with live orders they can trade on their personal accounts.

Alternatives To PyInvesting

Similar to PyInvesting, TrendSpider, and MetaStock, other worthwhile backtesting softwares. The programs impress on both the UI and capabilities fronts.

Would you join to discuss on this product ?