M1 Finance - Daily Trading Window For Investment Control

- Intuitive and easy-to-use platform

- Intelligent automation portfolio of stock and ETFs

- Less borrowing with high-yielding organisation

- Automatic account invest schedule integration

M1 Finance Advisor - Easy to Use Multi-optional Money Management Advisor

In the current economy, money and investment are an integral part of life. Investment becomes an important part of your life as you grow up. So, in that case, M1 Finance advisors come to your rescue to advise you and help you manage your accounts and investments effectively.

Unique Features M1 Finance Advisor

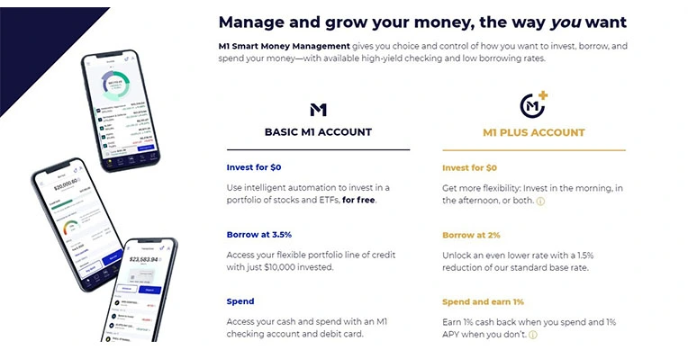

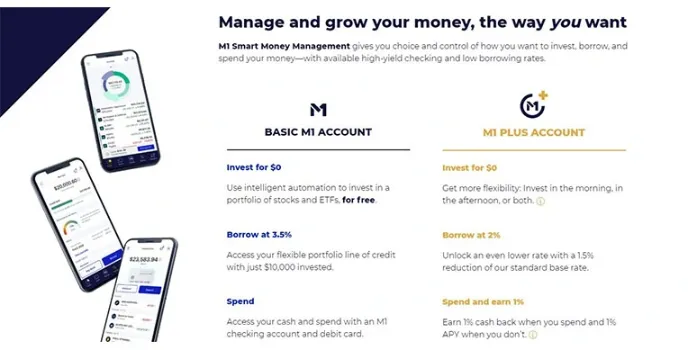

Easy-to-use annual subscription

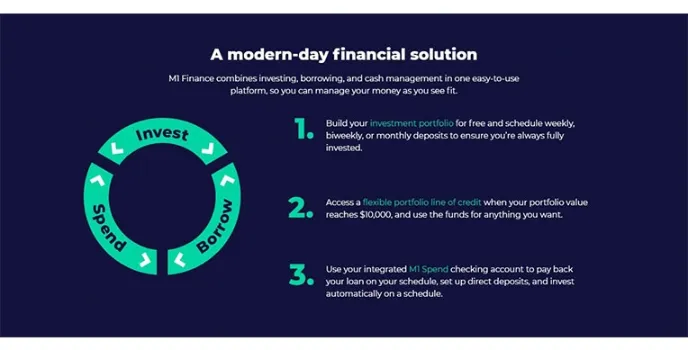

M1 Finance helps you to invest, borrow and spend, all in one place. It is an intuitive and easy-to-use investment management platform. You will have no annual and charges no fees for trade. The role of the M1 financial advisor is to guide clients regarding investments.

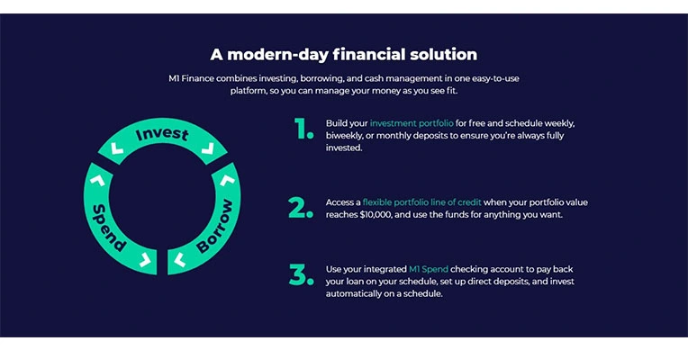

Automatic Balance

Numerous robo financial advisors help to manage financial programs. The M1 offers automatic balancing. You can invest in stocks, bonds, general investing, retirement investing, and many more.

Offers multiple account options

It offers multiple account options and enables you to track and check your investments from anywhere through your iphone or android. They have a customer support team that can be contacted by phone or email for all support-related issues.

Flexible portfolio

One of the major advantages of M1 is that with its flexible portfolio line of credit, you can borrow up to 35 percent of your portfolio. However, a brokerage account is mandatory with $10,000.

Proportional investment allocation

M1 robo finance advisor will maintain a proportional investment allocation, and it's the best choice if you want complete control over your investments. It's the best for new and hands-off investors.

Alternatives

One of the platforms is Ally, an intuitive trading experience, web-based trading on streaming HTML5 platform. With the help of dynamic trading experience, you can manage accounts and access portfolios. You can select your investment through self-directed trading or managed portfolios. Another financial tool is Betterment. A tool that helps to secure your retirement, it is a certified planner with unlimited support. Ideal for beginners, it is also an investment advisor platform. It will not only protect you from losses but also provide a money transfer facility.

Would you join to discuss on this product ?