LendingTree - Automatically Withdraw Repayment And Monthly Amount

- Online preliminary application for personal data

- Unlimited cashback and rewards to attract people

- Best lending for boosting creditworthiness

- Monitor credit and monthly interest rates

Lendingtree Loan and Finance - Money Lending Services for Various Purposes on Peer To Peer Basis

When it comes to loans and finance, borrowers look for the best rates that put the least amount of burden on them. Lending Tree is another such great personal finance software and platform wherein the borrowers can connect to the various lenders for personal loans, mortgages, and so much more.

Features of Lending Tree

Various Loans

The peer-to-peer lending for investors website conducts a preliminary online application for all the personal data. It provides unlimited cashback and rewards for attracting people and appealing to them. Lending Tree provides the best lending for enhancing creditworthiness and monitoring credit and monthly interest rates.

Great Benefits

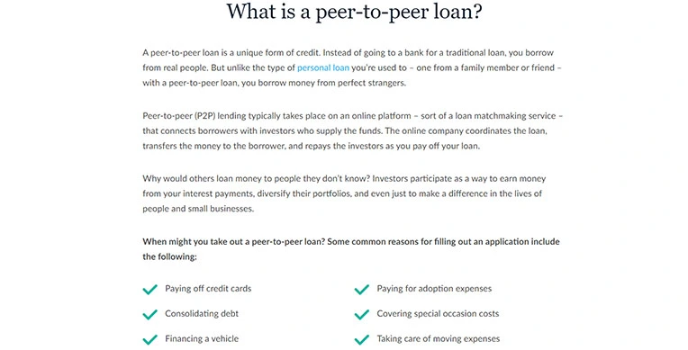

The website for peer-to-peer lending for investors offers certain financial services and tools like credit scores and credit card information. Borrowers truly benefit from the competition that exists between different customers, which can eventually result in lower interest rates and access to loans similar to Pay Off. Lending Tree offers the actual credit score once you finish the application and asks you a series of questions to confirm your identity. Moreover, it helps provide additional help through its customer service executives, and you can speak to them in case of any doubt.

Application Process

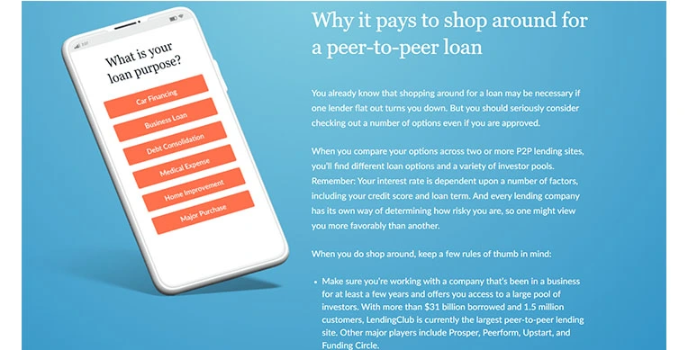

The application of loans and finance process is effortless, and the loan process is quite standard. You start with entering the information about the purpose of the loan, which could be a vacation or a debt consolidation or whatever. Lending Tree helps provide good financial loans, and once you decide the amount and the purpose, they check your credit rating. With the application, you will also need to include your employment and pre-tax income, address, and type of residence, and personal identification information.

Alternatives

The peer-to-peer lending for investors platform helps borrowers find different types of loans, all through a lending marketplace. The platform is not a lender itself, similar to Funding Circle and Pay Off, and multiple lenders participate for your business on this platform. This platform is one of the largest peer-to-peer online exchanges, and its main focus is to bring borrowers and lenders together to come to a consensus in terms of loans.

Would you join to discuss on this product ?