Indigo Card - Premium Credit Card With Mobile Account Accessibility

- Designed for business officials

- Advanced chip technology with fraud protection

- Professional customer and management service

- Trouble free approval process

Indigo Card - Advanced Chip Card Technology For Complete Protection

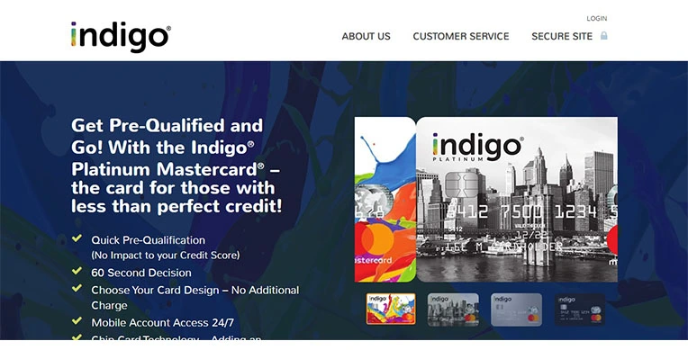

In today’s digital world, everything, including money, has become virtual. It must be spent or received via credit cards of the best payment methods. Indigo is one such card provider that works perfectly well for virtual and direct payments. They offer the best credit cards for travel to send and receive money without any geological restrictions. They are well suited for business people for transactions of big amounts.

There is an advanced chip technology installed in these cards to protect them against unauthorized usage. If only a standard initial credit limit is required, then there is no need to pay for any security deposit upfront. There is a requirement to pass the pre-qualification test for first-time users, which is relatively easier from tests of other credit card companies to acquire your own credit card. This test does not affect the credit score or the perks and benefits of the cards. Payments are reported monthly to the credit bureaus to check up on the history of transactions. The users can customize the cards from Indigo according to their taste in multiple colors and designs.

Like OpenSky credit cards and Capital Bank cards, Indigo provides replacement cards if there is any missing reported emergency. Also, there are different cash withdrawal features that are simple and uncomplicated to have access to your money anytime and anywhere necessary. They also benefit the cardholders with bonuses and rewards which do not expire while the account is still open. Try these cards for a complete revolution in your daily payments.

Would you join to discuss on this product ?