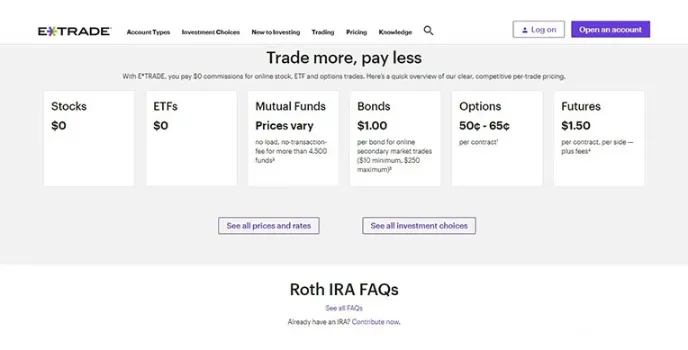

Etrade - Automated Portfolio For Investments And Withdrawals

- Retirement account plans for individuals

- Enhanced cash management features

- Compare all possible investment accounts

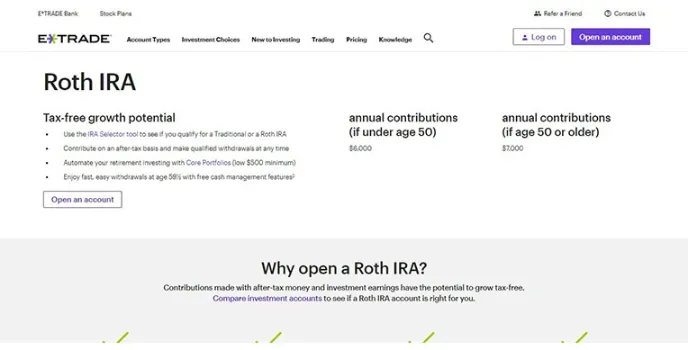

Etrade - The Easy Way To Tax Free Growth Prospect

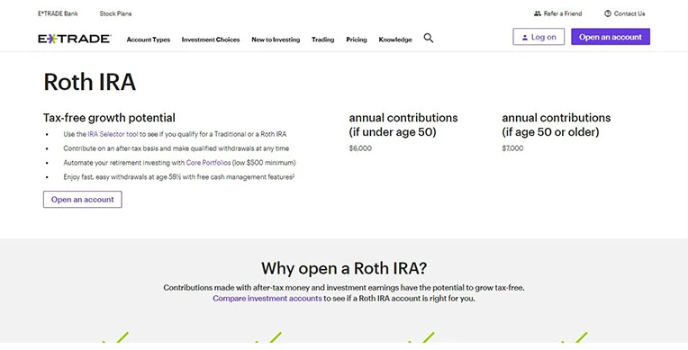

As per the Etrade Roth IRA review, it has been highlighted that you choose to avail the best Etrade services to invest in Roth IRA stock trading, which is the easiest way to tax free growth possibilities to put it precisely. The Etrade Roth IRA promotion speaks of the fact that the contributions that you make with investment earnings and that of after-tax earnings have the possibility to grow tax free. As per the IRA promotions, you can compare the investment accounts if the Etrade Roth IRA reddit account is suitable for you or not.

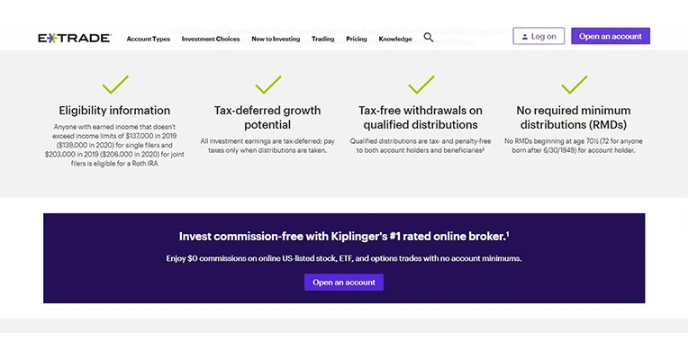

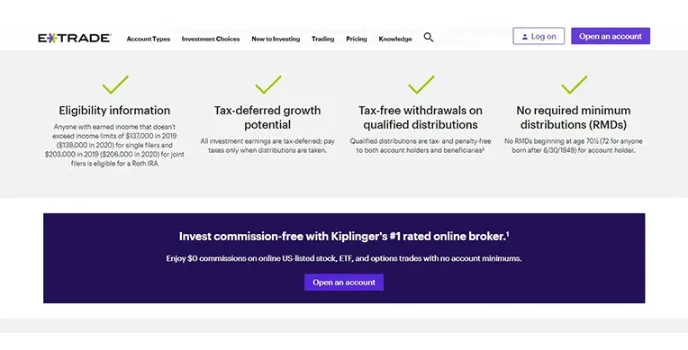

You can go in for Etrade to buy stock for Roth IRA, as their eligibility criteria is such that anyone with income earnings that isn’t more than $137,000 in the year 2019 ($139.000 in 2020) for single filers can plan a wide asset transfer out with their services. For joint filers you are eligible to Etrade buy stock in case your income earnings don’t exceed $203,000 in 2019 ($206,000 in 2020). Wondering how to be successful on Etrade? You can go in for the IRA selector tool to check out if you qualify for a Roth IRA or a Traditional one. As per the Etrade terms of withdrawal, you can enjoy easy, hassle free and quick withdrawals at age 59½ with free cash Etrade IRA withdrawal features. With the Etrade retirement account you can automate your Etrade retirement calculator and invest with Core Portfolios with an Etrade minimum deposit of only a minimum of $500. For all other queries like Etrade wire transfer fee, Etrade terms of withdrawal, or Etrade transfer money to bank, contact Etrade customer service for best assistance.

Would you join to discuss on this product ?