Betterment - Personalized Action Plan With Educational Content Package

- In-build tailored plans to secure retirement

- Get encryption data storage for better privacy

- Certified financial planner with unlimited support

- Ideal for beginner investor advisor platform

- Helps to protect from investment losses

- Give unlimited money transferring facility

- Provide smart tax strategies for achieving goals

- Premium plans with 0.25% annual fee

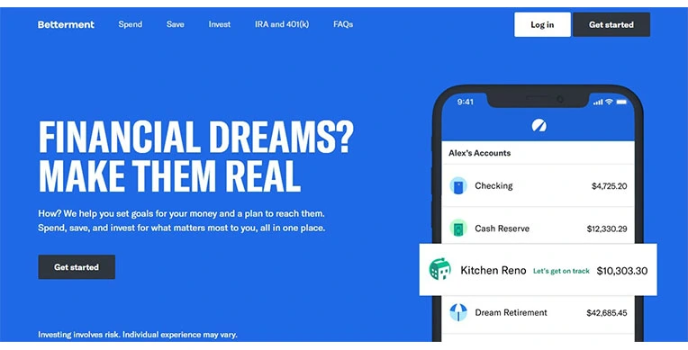

Betterment - A Money Manager Tool For Planning Retirement

If they earn a decent salary and work within their means of money and investment, most people are satisfied. If they do not have unmanageable debt, then they are happy. They believe that hiring a financial advisor is a waste of time and resources. But what if advice from experts helped them to handle their finances properly? You have to make sure you are headed in the right direction.

A financial advisor may advise; it is ultimately your decision to follow the advice given or not; it is about your assets, after all! So to make sure that your assets and hard-earned money are being used productively, various robo advisor services have cropped up. One such service is Betterment.

Must-Know The Amazing Features of Betterment

Easy Setup

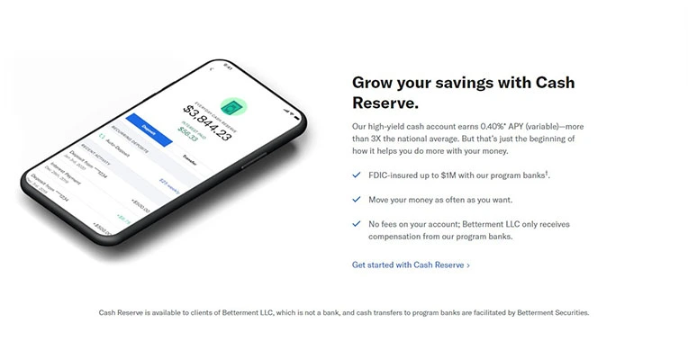

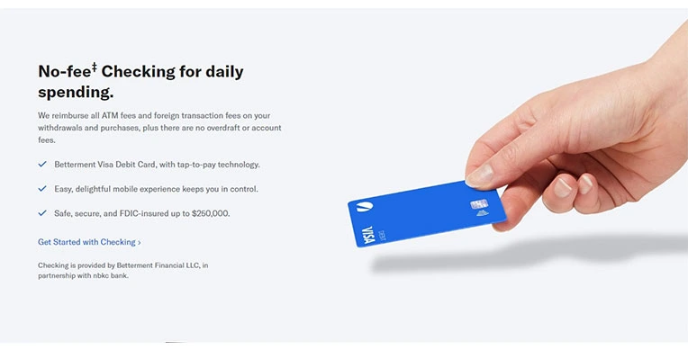

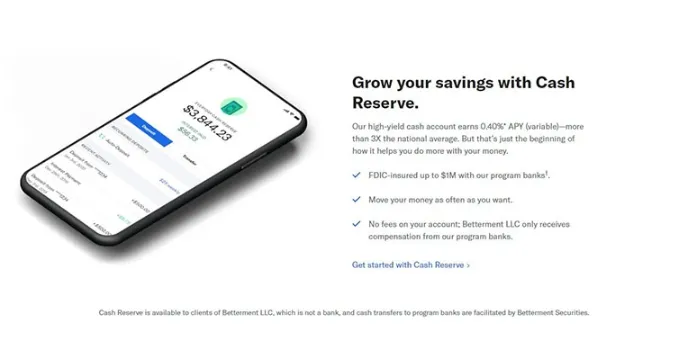

Betterment financial advisor ensures fast yet simple configuration of accounts. Until lending starts, portfolios are entirely transparent. Also, external accounts may be synchronized to individual targets. At any moment, you can add a new target yet monitor your progress with ease. You can also change portfolio risk easily or turn to a different portfolio type. The features of Checking and Cash Reserve give a two-way sweep.

Better Tracking

Betterment has very simple-to-follow steps to set a target. It is possible to track each one separately. Betterment has the simplest accounts to set up for mobile devices as well as streamline processes. The business launched Betterment Checking and Betterment Cash Reserve, its cash management offerings, in April 2020. Accounts are reviewed as well as rebalanced once a month if they have moved from their target allocation.

Retirement Planning

Betterment is an excellent tool for individuals looking to control their retirement portfolio, but as investors consolidate more of their Robo Advisor Services objectives into the platform, it really shines. The opportunity to monitor progress can be a major motivator for young investors. The tools for tax and portfolio management eliminate the headaches of manually adjusting and tracking a portfolio.

Customized Portfolio Plans

Rather than locking you into three risk scores, Betterment also offers a reasonable number of portfolio options and customizations. The socially conscious portfolios and digital-first strategy of Betterment are signals that the primary target is the younger investment crowd, which is understandable.

Alternatives

Apart from this, there are several other such services, such as SoFi and TDAmeritrade.

Would you join to discuss on this product ?