AIG - Retirement Services Maximizes Savings Income

- Offers maximum taxable savings

- Effectively increases all future earnings

- Ensures tax-free growth for investments

AIG - Towards A Secured Post Retirement Financial Future

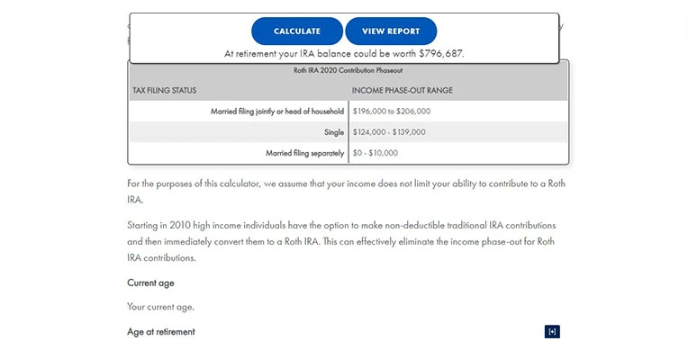

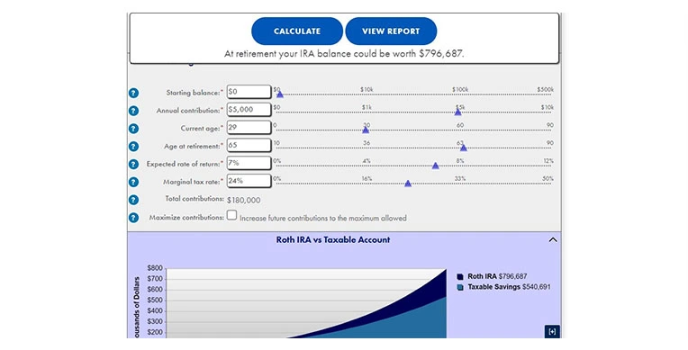

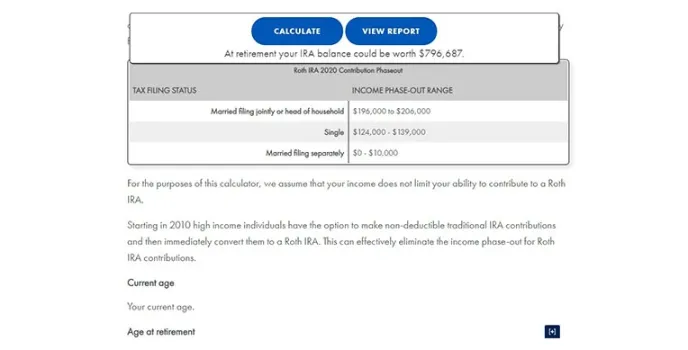

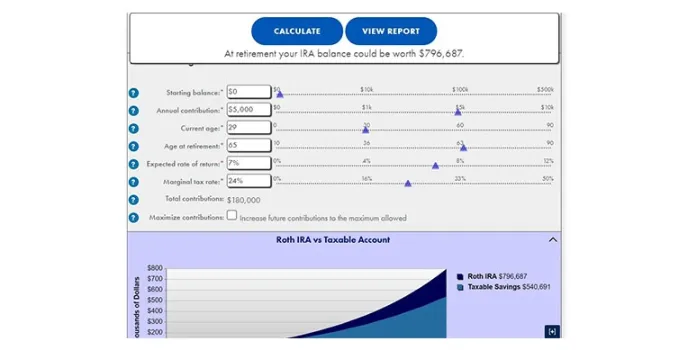

AIG retirement services offer you with different AIG retirement plans that you can purchase in the endeavour to secure your post-retirement financial future. As per the Roth IRA contribution calculator, contributing to a Roth IRA account could bring about a difference in terms of your retirement savings to put it precisely. You can go in for the Roth IRA account which is bound to work as ‘my retirement manager’, for contributions made to the Roth IRA account are free from any kind of tax deductions. Your retirement calculator, as well as your money and investment calculator, might highlight the fact that all your future earnings could be tax-free and even qualified distributions are tax-free as per the current tax laws for the matter.

It is among the best IRA Account websites that claim that Roth IRA calculator interest rates are such that it can make for truly tax-free growth in terms of AIG wealth management. The annual contribution for AIG simple IRA is the amount that you shall contribute to your IRA account every year. You can use your AIG Roth IRA login id to avail of the IRA excess contribution calculator which assumes that it is best to make your contributions at the beginning of each year for the matter. The maximum of annual IRA contribution is $6,000 which remains unchanged from 2019 for this best retirement services provider. For any kind of questions, queries or confusions regarding their services, like, traditional IRA calculator you can contact best AIG for further assistance give quality services than the voya or financial mentor.

Would you join to discuss on this product ?